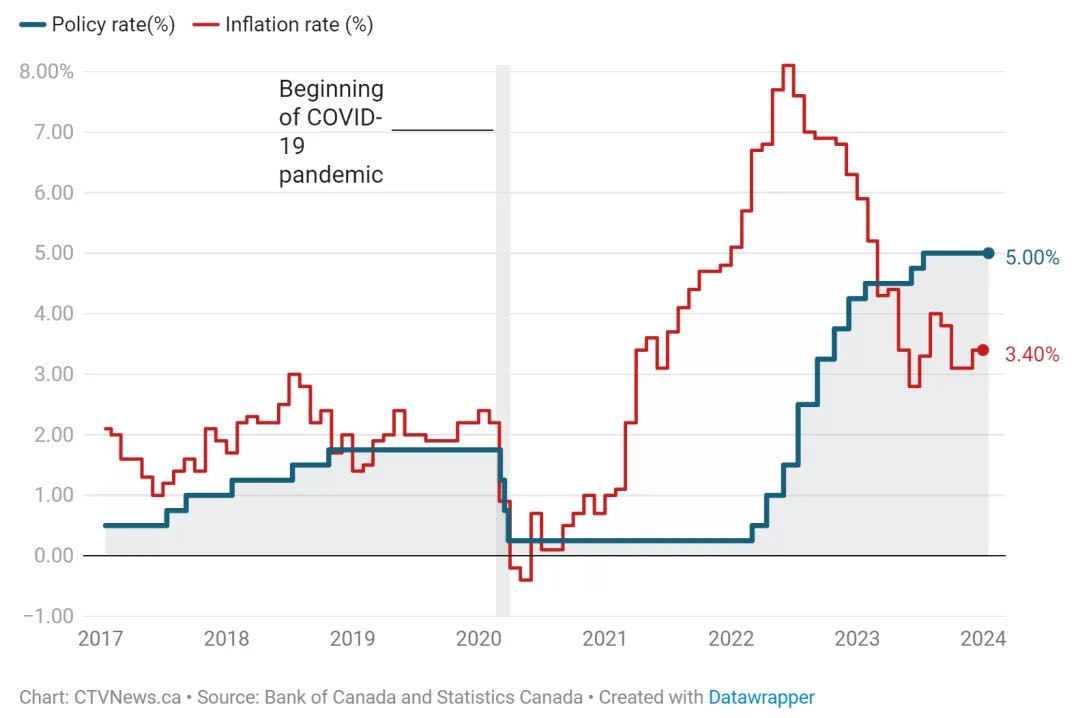

Today, January 24, 2024, the Bank of Canada announced that it will continue to maintain its benchmark interest rate at 5%. Economists are still highly attentive to signs of future rate cuts, expecting the rate to remain until mid-2024, at which point the Bank of Canada is anticipated to initiate a rate-cutting cycle.

The Bank of Canada is expected to cut interest rates as early as this spring to avoid a more severe economic downturn. Over the past year, soaring borrowing costs have put pressure on businesses and consumers, leading to a stagnation in the Canadian economy. Slowing economic growth has led to a reduction in the labor market bubble, a decrease in job vacancies, and an increase in the unemployment rate to 5.8%. The Bank of Canada's Business Outlook Survey found that labor shortages are no longer the main concern for businesses; instead, they are more worried about a slowdown in sales. Furthermore, the Consumer Expectations Survey indicates that due to the rise in interest rates forcing mortgage holders to cut back on spending, Canadians are also reducing their expenditures. This is expected to further cool the economy this year.

Economist Predictions

Manulife's economic outlook for 2024 indicates that the Canadian economy will shrink in the first half of the year before it starts growing again. Economists note, 'Whether or not there's a technical recession, this year is going to be a weak one. The question is, how long will this slowdown last? Can we achieve a sustainable recovery in the second half of the year?' The anticipated rebound in the second half is contingent on interest rate cuts. However, it's expected that the Bank of Canada will not yet start discussing rate cuts, especially after inflation rose last month. In December last year, Canada's annual inflation rate climbed to 3.4%, and the potential for price pressures did not ease. The core inflation index, which excludes volatile prices, rose last month, posing a greater challenge for the central bank. The price pressures in core areas are more persistent than we thought.

Inflation situation

The Consumer Price Index in Canada rose by 3.4% year-over-year in December, the Canadian Statistical Agency reported this week, following a 3.1% increase in the previous month.

The average of Canada's adjusted core inflation rate and median core inflation rate is 3.65%, which is higher than the 3.35% economists had anticipated.

Doug Porter, Chief Economist at CIBC Capital Markets, stated that the persistent core inflation rate above the target is 'disturbing news.' He expects that the Bank of Canada 'will maintain a firmly cautious stance in next week's rate decision.'

Impact on Borrowing

James Laird, Co-CEO of Ratehub.ca and President of CanWise Mortgages, stated, 'Interest rates are expected to remain unchanged. Borrowers with variable-rate mortgages or Home Equity Lines of Credit (HELOC) can expect rates to stay the same, but they will be closely monitoring the banks' moves to gauge whether rate increases or decreases are more likely in the future.'