Looking back at the past year, it can be said that 2023 was a severe test of resilience for Canadian mortgage holders. Looking ahead, there is an optimistic expectation that 2024 will be a year of interest rate cuts. To understand the changes that interest rates and the housing market will bring in 2024, Anxin Loans has compiled predictions from financial experts at major banks for you.

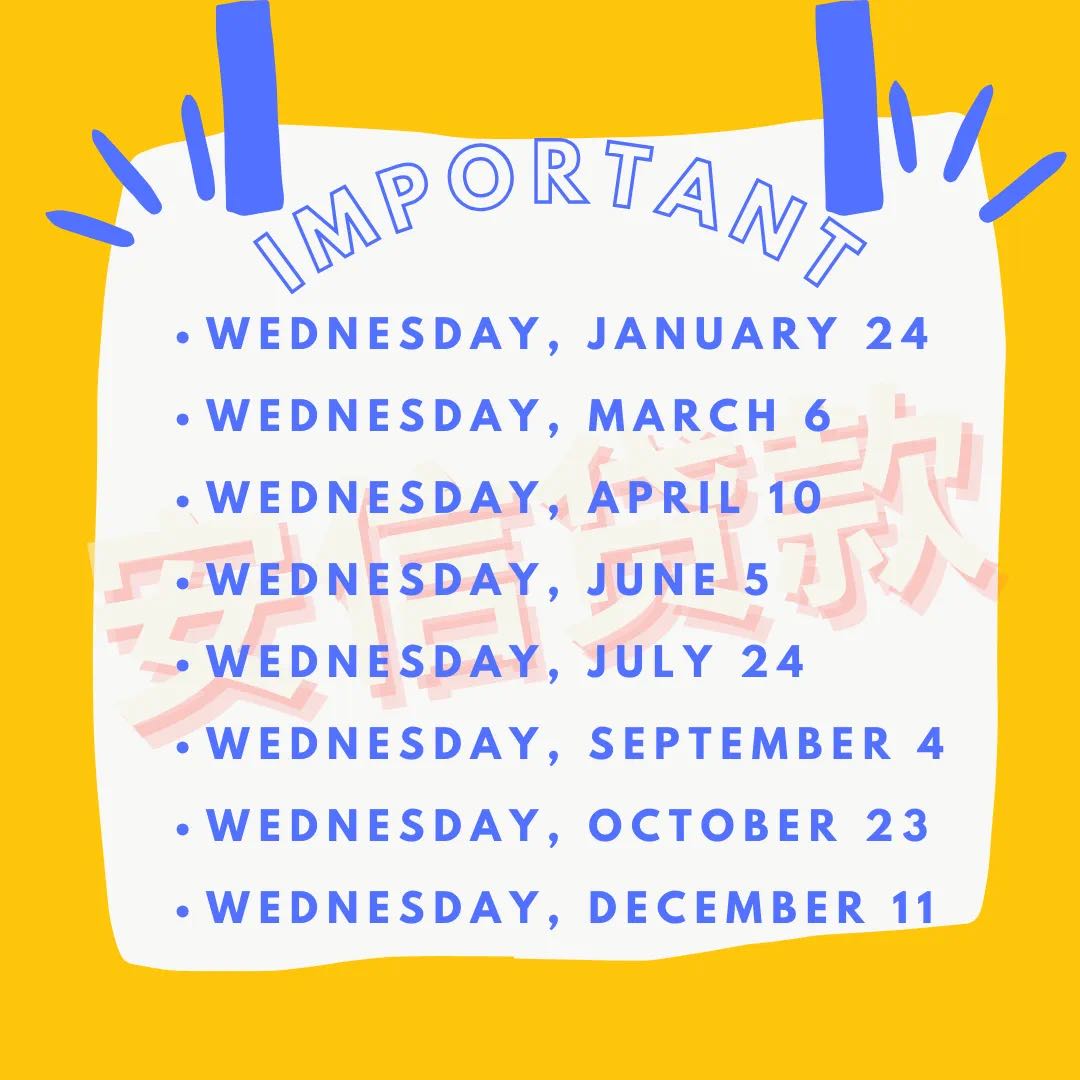

I. Key Dates

2024 Bank of Canada interest rate adjustment dates

II. Economic Expert Predictions and Analysis

TD Bank

Forecast for residential sales growth in 2024: +5.2% Forecast for residential price growth in 2024: +0.5%

Expert CommentaryA more sluggish economy than expected poses a severe downside risk to the real estate market outlook, negatively impacting demand and potentially leading to forced sales. Another key risk is that if the level of inflation is higher than our expectations, interest rates will remain above the predicted levels. Conversely, Canada's population continues to grow robustly, which means that the housing shortage is likely to persist. This may drive house price growth beyond expectations.

RBC Bank

Forecast for resale of homes in 2024: 496,000 units (a 9.4% increase year-over-year) House price forecast for Q4 2024: $799,900 CAD (an increase of 1.9%)

Expert CommentaryTransaction activity in the resale housing market is expected to remain relatively quiet in Ontario and British Columbia until there is a significant decrease in interest rates. The recovery thereafter may initially be gradual. However, in other markets, buyers might respond more swiftly to easing interest rates.

The latest round of housing affordability data is gradually improving, and the situation is expected to get better from now on, with house prices in most markets either declining or stabilizing and household incomes continuing to grow robustly. However, before affordability truly recovers, buyers in many of Canada's large cities will still face extremely challenging conditions for a considerable period.

III. Overall Interest Rate Forecast for Canada in 2024

In summary, 2024 could be a year of interest rate relief. The bond market predicts that there is about a 15% chance that the Federal Reserve will start cutting rates as early as January. Although this probability is low, most economists expect the Bank of Canada to make its first rate cut before the middle of the year.

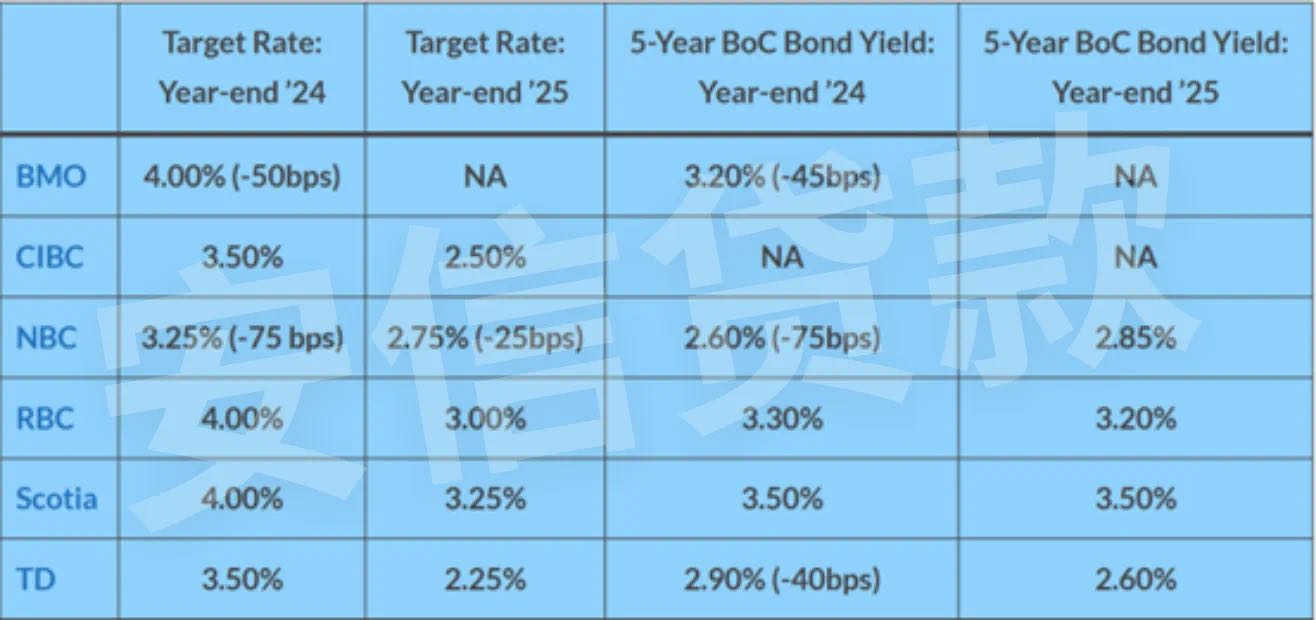

Forecasts from the Big Six banks indicate that the overnight target rate will fall to at least 4.00% by the end of 2024, from the current rate of 5.00%. Bond yields, a leading indicator for fixed mortgage rates, are also expected to reach their peak.

Since early October 2023, the yield on Canadian government 5-year bonds has fallen by more than one percentage point, leading major national banks and other mortgage lending institutions to start reducing fixed mortgage rates.

IV. Latest Interest Rate and Bond Yield Predictions from the Major Six Banks